With the RGB protocol, users can allocate altcoins to Bitcoin UTXOs, enabling stablecoins transfers on the Lightning Network and more.

The Lightning Network is arguably the most impactful and important innovation ever seen in Bitcoin. It enables fast and cheap transactions that take up no space on the blockchain, while preserving all of Bitcoin's censorship-resistant and trustless features. While Lightning still has space to grow and improve, both in terms of technological stability and adoption, it has already proven to be an irreplaceable solution for cheap, trustless payments, with more than $100 million in network capacity and an ever-growing number of businesses adopting it as a payment method.

Such innovations favor the adoption of Bitcoin, but they can also be beneficial for other types of digital assets. Currently, most blockchain-based digital assets are issued as altcoins, which do not offer the same guarantees of security and censorship resistance as Bitcoin does, as they aim to achieve cheap, low-latency transactions by sacrificing decentralization, meaning that they operate as de facto semi-centralized systems. But with the ability to move digital assets over the Lightning Network, many use cases that require cheap and fast transactions could finally be able to benefit from Bitcoin's trustlessness as well.

One already popular use case that would certainly benefit from that would be stablecoins. Examples like USDT are already widely-used for digital payments and remittances, especially in developing countries where the legacy financial infrastructure is not always functional and the local currencies are volatile.

With Lightning, more and more people could adopt stablecoins and use them for payments. This would be beneficial in improving the financial stability of people otherwise forced to use a local currency that is (even) more unstable than the U.S. dollar, while also bringing them one step closer to adopting Bitcoin as they become familiar with its technology, even while they are still not comfortable with its volatility. Also, additional digital assets on Lightning would not only benefit the diffusion of stablecoins and other tokenization use cases, but they would simultaneously help Bitcoin itself, as more technologically-compatible infrastructure would be built (e.g., the payment terminal accepting stablecoins on Lightning would very easily also accept bitcoin).

Moreover, once there are stablecoins and other assets on the Lightning Network, it becomes possible to have decentralized exchange functionalities directly over Lightning, with two nodes being able to atomically swap bitcoin against other assets at the same speed and cost of a Lightning payment, without counterparty risks. This represents a significant improvement to the current state of decentralized exchanges (DEXes), meaning that more people will be able to move away from centralized exchanges and stop having to trust a third party with their collateral.

Bringing More Digital Assets To The Lightning Network

So, how can all of this be achieved?

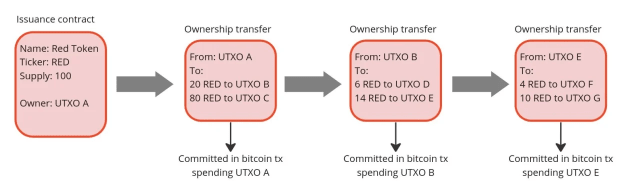

First of all, we need a way to issue and transfer assets on the Bitcoin blockchain, and this is possible with the RGB protocol, which enables users to create an off-chain contract that issues new assets and allocates them to a Bitcoin UTXO. Such assets can then be moved around using client-side validated transfers (you can read more about how RGB works in this previous article).

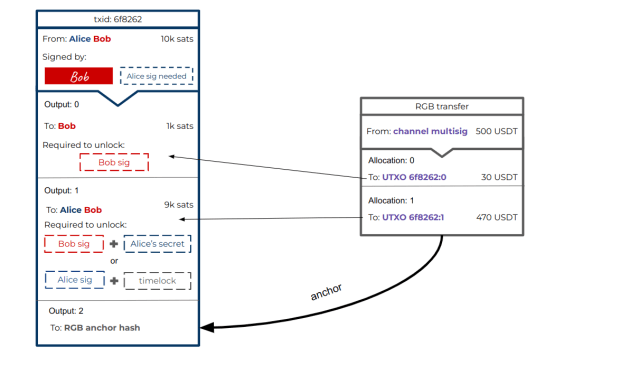

Once we have RGB assets on chain, it is possible to add them to Lightning channels by sending them to the multisig UTXO used for the channel opening, and once inside it, they can be moved and routed between the participants, similarly to regular bitcoin Lightning payments.

To guarantee the security of an RGB channel, at each channel update the assets are sent from the funding multisig to the outputs created by the Lightning commitment transaction, meaning that if an old state of the channel is broadcast, it is possible to trigger an RGB punishment transaction (along with the Bitcoin one) and take all of the RGB assets of the attacker.

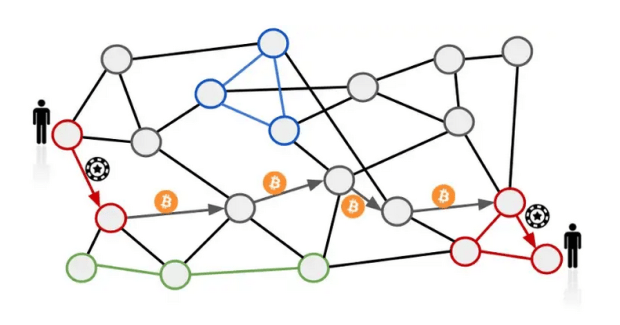

It is worth noting that for a payment to be successfully finalized, it requires all channels it gets routed through to have sufficient liquidity in the specific asset being transferred. This means that every RGB asset needs to have its own Lighting Network graph, and realistically, only very popular assets can achieve it (e.g., stablecoins).

Beyond Popular Stablecoins

For less-popular assets, however, there are still a couple of options available to leverage RGB’s Lightning Network compatibility. The simpler one is to bootstrap a quite-centralized network where everyone connects to a limited number of main nodes, relying therefore on an almost hub-and-spoke-style model. While this does not offer the same censorship resistance guarantees of a more decentralized network, it can still serve the purpose for a lot of use cases (e.g., in-game tokens).

A second available option is to use exchange nodes to swap a low-liquidity asset against a more-liquid one, using the latter to more easily route the payment closer to the destination, and then swap again against the lower liquidity asset so that it can be delivered to the beneficiary of the payment. This solution is also not without problems, however, as exchange nodes will charge a spread to offer the swap service, which for illiquid assets is likely to be significant, and it has to be paid twice.

Regardless of the inevitable frictions that will exist for illiquid assets, having easily-accessible liquidity bridges between assets is greatly beneficial to create a more interconnected ecosystem with multiple projects also being able to contribute to the same technological infrastructure.

The Building Blocks Are Ready To Be Used

So, what's the current stage of development around RGB on Lightning? Recently, Bitfinex's RGB team (of which this author is a part) released rgb-lighting, a fully-working Lightning node for RGB assets, which on its own represents a major technological achievement. And, at the same time, other Lightning implementations are also planning to support RGB, such as Maxim Orolvsky's LNP node. While still not mature enough at the time of this writing (March 2023) to be used with large amounts of money, all of the technological stack and building blocks needed to start building applications and use cases on RGB and Lightning are there and ready to be used.

For a better understanding on how RGB works and how assets are moved inside of Lightning channels, visit rgb.info to find more resources.

This is a guest post by Federico Tenga. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

source https://bitcoinmagazine.com/technical/how-rgb-enables-altcoins-on-bitcoin

Post a Comment