A 1999 article by Nick Szabo is often cited to argue that micropayments don’t work. But with Bitcoin and the Lighting Network, now they do.

This is an opinion editorial by Jared Nusinoff, the founder and CEO of Mash, a Bitcoin- and Lightning-Network-based micropayments platform.

I’m sick and tired of hearing about Nick Szabo’s “Micropayments And Mental Transaction Costs” post from 1999.

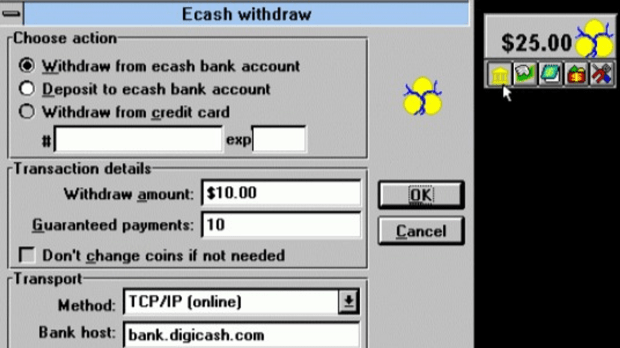

When talking about micropayments, there are many doubters and detractors. For them, micropayments is a “dirty word.” They almost always reference the “failed” attempts related to creating a digital currency akin to bitcoin — like the eCash payment system by David Chaum’s Digicash in the ’80’s and ’90s. Yes, it failed. But that’s not about micropayments.

They occasionally reference failed attempts at bundling content, charging users subscription fees and then micro-distributing the revenue based on usage. But that’s not about micropayments, either.

They don’t consider the successes of the online applications of micropayments from over 15 years ago, as seen in gaming and digital media. They don’t reconsider what is possible now that we have enabling infrastructures like Bitcoin and the Lightning Network. They all reference and anchor on this “kill shot” essay by Nick Szabo.

“This will never work. Haven’t you read ‘Micropayments And Mental Transaction Costs’ by Nick Szabo?”

“Is Szabo wrong about something? Is that even possible? That can’t be!!!!”

Or maybe, Szabo may have been right at the time and things have changed in the subsequent 24 years.

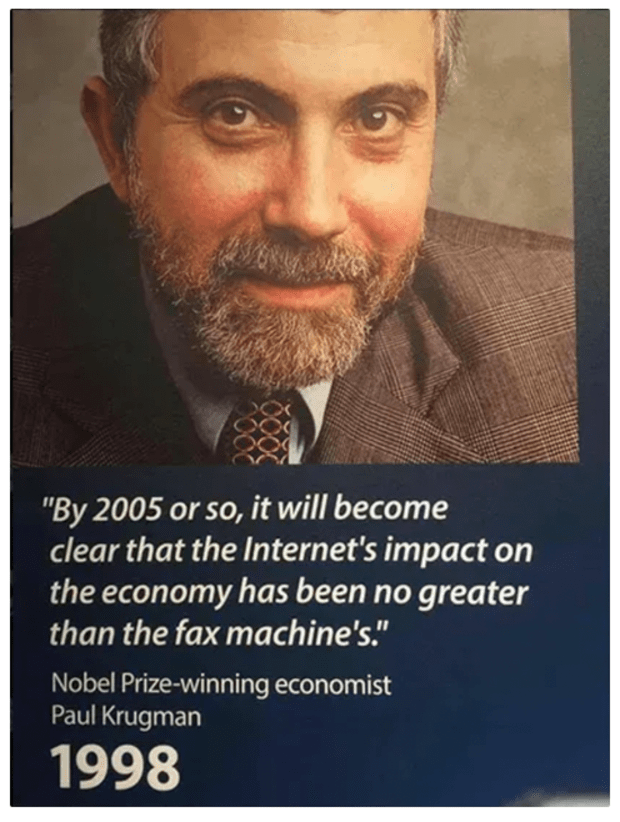

There are always detractors.

It didn’t work then, it won’t work now. Did they forget to ask “why now?” and “what’s changed?” Did they pause to properly consider what the Szabo article was actually arguing? Do the use cases referenced apply to the experiences in question?

It’s been 24 years. Things have changed. Technology changes. The internet is different. Money is different. The opportunities to apply micropayments to experiences are different.

And let’s not ignore that Szabo’s opinion has been further articulated, and that it changed. He wrote a follow-up paper, in 2007, mentioning some of the places that micropayments (not nano-payments) are working. And the extra discussion in the comments sections is fantastic, and add color to his thoughts, some of which are referenced below.

Yes, Mental Transaction Costs Matter

“The lesson for micropayments is that mental costs usually exceed, and often even dwarf, computational costs. (Big) reductions in computational costs (are) often economically insignificant… (mental) costs will increasingly come to dominate.

–Szabo, 1999

The article’s high-level point is that making a decision to purchase something is a huge hassle, forcing you to incur a large mental transaction cost — and this decision point for people is the critical and most challenging obstacle for micropayments to work. It isn’t the reduction in the costs for providing the product or service — that was simply a necessary enabler to having the cost structure for charging micropayments. If you want to purchase something for, say $0.01, the human thinking cost is what matters.

It all boils down to addressing questions like these, which apparently people ask themselves when making a purchasing decision: How much will this cost? How much will I have to spend on other things? What am I buying? How does it meet my needs? How does it compare to other options? How do I figure out the best choice? Did I get what I paid for? How do I account for and know when/how I am paying?

But do people really ask all of these questions? Do these questions apply to every potential purchase?

In light of these mental transaction costs, the previously-enforced size limits from contemporary payments networks and their lack of interoperability, you can lean into the mentality of: Think once and subscribe. Aggregate it. Bundle it all up. Or give it away for free and toss on some ads and perhaps some donation requests.

End of story? No!

These are surmountable when applied to the right things that benefit from a highly-granular payments system — with amazing user experiences that remove the mental transactions costs.

Let’s not get it twisted. Szabo was really talking about “nano-payments” for utility type experiences, like internet packets.

“Nowadays many people call even a dollar a ‘micropayment’ because it's smaller than your typical credit card payment, and this muddles the issue. PayPal and some services like iTunes have shown that there's at least a significant niche market below typical minimum credit card payment, but it hasn't shown that micropayments of the kind I talked about are feasible.”

–Szabo, 2007

“People are not going to run around bidding two cents here… just to be able to get good bandwidth or response time.”

–Szabo, 2007

When people reference this article, they are talking about a completely different definition of micropayments than what the article was focused on. And they are applying it to a much broader set of use cases than could have even been imagined back when the original article was written — not in the way that Szabo was focused on.

Szabo was primarily talking about the challenges of consumer nano-payments for generalized things like internet packets, storage space, bandwidth, energy, text messages and more — thinking about the cost of a phone call or text message every single time. If you were micro-charged for use of something that you will spend a lot of money on, how would you account for it and keep track?

Let me just buy an unlimited texting package and not think about it. There’s no differentiation, it’s a utility and it should just work. Got it. And I agree! That’s because it is a personal math value/cost problem for users — because these are utilities that are abstracted away from what individual people really value.

What is missing in the nano-payments-for-utilities equation are the experiences that people care about. Ones to do with status, access, connection, beauty. Experiences that are interactive, and that connect you. The end product, not the plumbing that enables it.

Things Have Changed

1999, the good ol’ days.

It’s the height of the dot-com bubble. You smile when you hear the intoxicating, screeching sound of your dial-up modem connecting. The space jam website was fading out of the zeitgeist. eBay recently updated its website with multiple fonts and some classic clip art. The early adopters are using MapQuest to print driving directions. AOL, Yahoo, MSN, eBay and Lycos are the most popular sites, receiving between 100 million to 400 million monthly visitors (out of the roughly 415 million people online).

Szabo publishes his micropayments article. Napster launches a month later.

The internet today is different. Social media, iPhone, Google, the creator economy, no-code tools, drop shipping, e-commerce, video streaming services, live chat, Twitter, Nostr, Bitcoin, the Lightning Network and so much more.

You can be brilliant at one point in time based on what exists — and eventually be wrong as things change, be misunderstood or both.

Let’s move beyond the past. Let’s get creative about the future.

Most attempts to mathematically model human behavior, or predict how technology will change the world are almost always wrong. They are abstractions — divorced from humanity and the new experiences that can benefit from changes. And in this case, new forms of money driven experiences.

Now, can we take this new technology and create magical experiences? Yes.

But that’s not what the Szabo article was about, now was it?

Even Szabo Is Open That It Can Be Solved For Specific Use Cases

At least, as of a comment from the micropayments redux article he wrote in 2007. Only he really knows right now what he thinks and what it applies to. So, if you’re going to only reference that one article… why not reference some of his other thinking?

“So far micropayments people have been mostly ignoring this crucial user interface / mental transaction cost problem and (because they've been ignoring it, and because it's usually a very hard problem) generally have not solved that problem. Thus micropayments have failed.”

–Szabo, 2007

“If, on the other hand, somebody can figure out a way for the user to input their budget and preferences, such that the mental transaction costs are sufficiently low, then it may work.”

–Szabo, 2007

And “micropayments” work, and he has even referenced this in his later thinking.

With online advertising, people are paying per click/conversion. This is a direct counter example to the utility/packets type use for nano-payments that Szabo was focused on when conversion and sales optimization tracking was at a minimum. Albeit it is a business use case, not a consumer one. The point is, they’re willing to do the math.

With digital goods, people were buying up ringtones to the tune of $4.4 billion in 2005 for about $0.99 each. That is a lot of ring tones!

And with music, Apple was just getting started, generating revenue to the tune of $1.7 billion in 2007. Pay per song. Pay per album. No problem. For a variety of structural reasons related to licensing and content ownership, along with consumers’ preferences given the medium, these naturally moved to bundles with subscriptions. But that isn’t the point. The mental transaction cost barrier was surmounted and it worked, when it made sense.

Today, nearly $68 billion is being spent for online microtransactions — much of it for add-ons, mods, boosts and more to improve gaming experiences. Each item purchase requires mental transaction costs even if it is, today, using in-game tokens. Now imagine what happens when the initial purchase isn’t a bundle of tokens, but simply digital cash that you already have, available in the game or a website.

The successes were unique things that people liked explicitly, and were willing to pay for by clicking a button, and typing in a credit card’s information — something they valued, and got enjoyment out of. And they worked, even though making the payment had serious overhead and friction!

And there’s way more of these types of experiences online that can take advantage of it! We just didn’t have the digital money yet. We do now with Bitcoin and the Lightning Network.

Just Getting Started

New micropayment experiences are just getting started, and proliferating with Bitcoin and the Lightning Network.

Before, we only had antiquated credit and debit cards — which require large, minimum purchase amounts; charge high fees; present large chargeback cost risk; offer no interoperability; introduce consumer input friction and challenges for international use; and have no flexibility to make them programmatic.

Today, we have Bitcoin and the Lightning Network. Interoperable, global money, that can be moved in any amount, including nano-amounts, at the speed of bits. It’s being adopted rapidly, the fastest-growing tech of all time, and is the future of money.

We’re watching the growth of new consumer use cases showing fundamentally new interactions that have nano-payments at the heart of it. From people “liking” with money on submissions/replies with a click on Stacker News, streaming sats to podcasters on Fountain FM, earning and sending bitcoin in games by THNDR and Zebedee. And there are inklings that it could work for funding the decentralized messaging protocol’s utility-driven relays on Nostr, not to mention direct consumer nano-payment tipping akin to likes with zaps.

Szabo Is Brilliant

His willingness to share his ideas, articulate them beautifully and all that he’s done for computer science, cryptography and Bitcoin is a boon to humanity. Think about it, his article is still being discussed 24 years later! And he hasn’t written about it in detail (that I know of) since the Lightning Network has started taking off. And all we can hope for is that we’ll get the opportunity to learn from his latest thinking in another article, perhaps titled “Micropayments: The Bitcoin And Lightning Redux.”

Building With The Revolutionary Possibilities In Mind

Doing our own research and building the future of online monetization with micropayments… maybe even nano-payments depending on your definition — that’s what many of the amazing builders on the Lightning Network are doing.

The promise of unlocking nano-payments with no mental friction is what we're working on at Mash. Join the movement. Join us.

“I hope I haven't overly discouraged people from looking at these fascinating and potentially quite lucrative and revolutionary possibilities.”

–Szabo, 2007

How do you like them apples?

This is a guest post by Jared Nusinoff. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

source https://bitcoinmagazine.com/culture/with-bitcoin-micropayments-can-work

No comments:

Post a Comment